Almost 520,400 VA loans were financed nationwide last year, totaling over $199 billion for Veterans and their families.

Start your VA loan quote onlineVA loans are one of the most powerful mortgage options on the market for Veterans, active military and surviving spouses.

The power behind the VA loan comes from a handful of significant financial benefits not typically found in other mortgage types. These advantages compared to different loan options are a big reason why VA loan volume has grown considerably over the last 15 years.

Benefits that Matter to Veterans

This historic benefit program has helped millions of Veterans, service members and military families achieve the dream of homeownership. As a result, VA loan use has soared over the last 15 years, and these government-backed loans are arguably one of the best mortgage products on the market today.

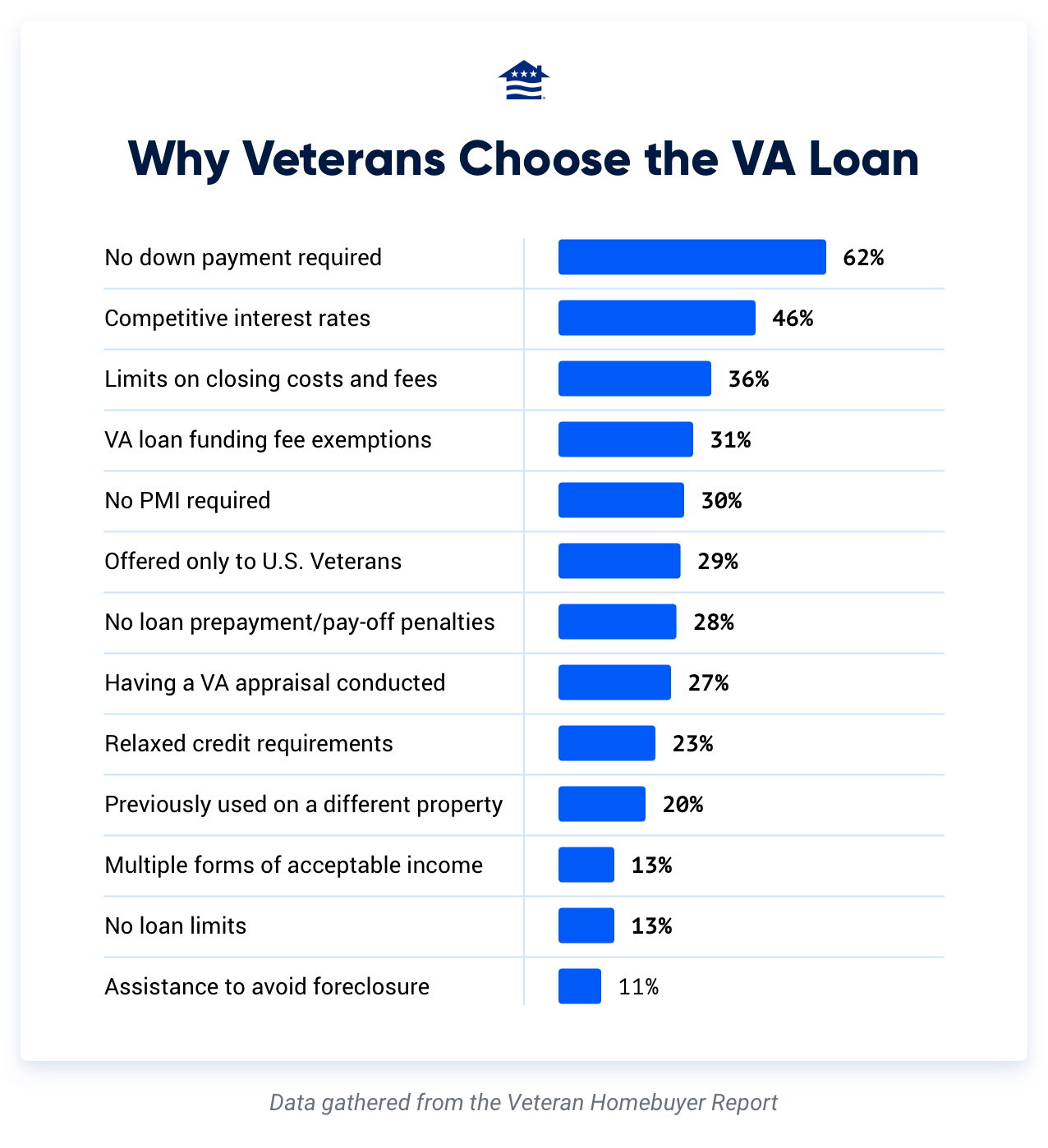

We surveyed over 1,000 Veterans and active military members. Here are the top reasons for choosing a VA loan among those who used their VA benefit:

Why Veterans Choose the VA Loan

| Reason why Veterans choose the VA Loan | Percentage of Veterans who choose reason |

|---|---|

| No down payment required | 62% |

| Competitive interest rates | 46% |

| Limits on closing costs and fees | 36% |

| VA loan funding fee expemptions | 31% |

| No PMI required | 30% |

| Offered only to U.S. Veterans | 29% |

| No loan prepayment/pay-off penalties | 28% |

| Having a VA appraisal conducted | 27% |

| Relaxed credit requirements | 23% |

| Previously used on a different property | 20% |

| Multiple forms of acceptable income | 13% |

| No loan limits | 13% |

| Assistance to avoid foreclosure | 11% |

Data gathered form the 2022 Veteran Homebuyer Report

Let's take a deeper look at the most significant VA loan advantages.

1. No Down Payment

By far, the single-largest benefit of the VA loan is that qualified Veterans can purchase without a down payment. This huge advantage allows Veterans and service members to buy homes without having to spend years saving for that typical lump-sum payment.

Check your eligibility for a 0% down VA loan

The minimum down payment amount on an FHA loan is 3.5%, and for conventional financing, it's often 5%. On a $250,000 mortgage, a military borrower would need to come up with $8,700 in cash for an FHA loan and $12,500 for a typical conventional loan. Those can be significant sums of cash for the average military borrower.

Saving money and building credit can be difficult for service members who are constantly on the move. With the VA loan, qualified borrowers can finance 100% of the home's value without putting down a dime.

Take a look at the chart below to see how much you can save through the 0% down benefit of the VA loan.

VA Loan Savings at Closing

| Loan Amount | 0% Down | 5% Down | 10% Down | 20% Down |

|---|---|---|---|---|

| $150,000 | $0 | $7,500 | $15,000 | $30,000 |

| $250,000 | $0 | $12,500 | $25,000 | $50,000 |

| $350,000 | $0 | $17,500 | $35,000 | $70,000 |

| $450,000 | $0 | $22,500 | $45,000 | $90,000 |

| $550,000 | $0 | $27,500 | $55,000 | $110,000 |

2. No Private Mortgage Insurance

Private mortgage insurance (PMI) is insurance that protects lenders in case of a borrower default. Many conventional lenders require borrowers to pay private monthly mortgage insurance unless they can put down at least 20%, which can be challenging. Conventional borrowers will typically need to pay this monthly fee until they build 20% equity in the home.

FHA loans feature their own forms of both upfront and annual mortgage insurance.

Unlike conventional and FHA loans, VA loans don’t require monthly mortgage insurance. No private mortgage insurance means Veterans who secured a VA loan last year will save billions in mortgage insurance costs over the life of their loans.

No PMI allows Veterans to stretch their buying power and save.

Estimated Monthly PMI Savings: VA vs. Other Home Loan Types

| $150k Home Price | $250k Home Price | $350k Home Price | $450k Home Price | $550k Home Price | |

|---|---|---|---|---|---|

| VA Loan (0% down) | $0 | $0 | $0 | $0 | $0 |

| Conventional Loan (3% down, PMI 0.5%) | $61 | $101 | $141 | $181 | $221 |

| FHA Loan (3.5% down, PMI 0.55%) | $67 | $111 | $156 | $201 | $246 |

| Monthly VA Savings | $61 - $67 | $101 - $111 | $146 - $156 | $181 - $201 | $221 - $246 |

3. Competitive Interest Rates

Here’s another big way the VA loan program saves Veterans money: Having the lowest average fixed rates on the market.

VA loans have had the lowest average 30-year fixed rate on the market for the last 10 years, according to Optimal Blue data.

VA interest rates are typically 0.5% to 1% lower than conventional interest rates. Lower rates help Veterans save every month and over the life of their loan.

Lower Interest = More Savings

| Loan Amount | $150k | $250k | $350k | $450k | $550k |

|---|---|---|---|---|---|

| Savings from a 0.5% reduction in interest | $14,760 | $24,480 | $34,200 | $43,920 | $54,120 |

| Savings from a 1% reduction in interest | $28,800 | $48,240 | $67,320 | $86,400 | $105,600 |

4. Relaxed Credit Requirements

Since the Department of Veterans Affairs only oversees the loan program and does not issue loans, the agency does not set or enforce credit score minimums. However, most VA lenders use credit score benchmarks to help assess a borrower's risk of default.

Credit score cutoffs can vary, but the minimums are typically lower than what borrowers need for conventional mortgages.

Veterans don't need anything near perfect credit to secure home financing at competitive interest rates. VA loans are also more forgiving when bouncing back after a bankruptcy, foreclosure or short sale.

5. Closing Cost Limits

All mortgages come with fees and closing costs, but the VA actually limits what Veterans can be charged when it comes to these expenses. In fact, some costs and fees must be covered by other parties in the transaction. These safeguards help make homeownership affordable for qualified homebuyers.

VA borrowers can ask a seller to pay all of their loan-related closing costs and up to 4% in concessions, which can cover things like prepaid taxes and insurance, paying off collections and judgments and more.

There's no guarantee the seller will agree to that request, but Veterans can certainly ask during the negotiation process.

6. Lifetime Benefit

One of the most common misconceptions about the VA mortgage program is that it's a one-time benefit.

Veterans who qualify for a VA loan can use this program over and over again, and the benefit never expires. Unlike what you may have heard, you don't necessarily have to pay back your VA loan in full to use your benefit again.

It's even possible to have more than one VA loan at the same time with second-tier entitlement.

Using your VA home loan benefit in the past doesn’t necessarily mean you’ve lost your eligibility — you may still be able to use it again. If you already have a VA mortgage at your current duty station, you can still use your benefit to purchase another home when you PCS across the country.

Start my VA loan with Veterans United Home Loans — the Nation's #1 VA Lender for Homebuyers†

7. No Prepayment Penalties

With some types of loans, paying off a home loan before it matures results in a pre-payment penalty. This is because lenders miss out on additional opportunities to collect interest payments. The prepayment penalty is a way for financial institutions to recoup some of that money.

The VA loan allows borrowers to pay off their home loan at any point without having to worry about a prepayment penalty. Borrowers are free to consider future home purchases and refinancing options with the absence of a prepayment penalty.

8. Foreclosure Avoidance

VA loans are one of the safest loans on the market and have been for more than a decade. That's pretty remarkable considering that about 75% of buyers don't make a down payment.

The VA mortgage program has emerged as a safe harbor for several reasons, including the VA's residual income guidelines. The VA has also done a tremendous job advocating for Veterans in jeopardy and working to ensure they stay in their homes.

The VA guaranty program isn't just about getting Veterans into homes. It's also focused on helping Veterans keep them.

9. The VA Appraisal

The VA appraisal is a required step of the homebuying process to assess the property’s value and high-level condition. The appraisal serves two purposes: establish an appraised value for the home and ensure the home meets the VA’s Minimum Property Requirements.

Establishing an appraised value verifies the home is priced at “fair market value.” This means the home is priced similarly to houses of the same size, age and location. The VA appra

The VA’s Minimum Property Requirements aim to serve as an additional safety net for Veterans. These high-level property condition guidelines are meant to help ensure Veterans buy homes that are safe, sound and sanitary.

10. Acceptable Income

Verifying income is an essential step in the VA loan process. Lenders want to make sure the prospective borrower can afford their new monthly mortgage payment. Many VA lenders will accept multiple forms of income.

While salaries and wages are the most common forms, lenders may count the following payments as effective income:

- Basic Allowance for Housing

- Disability Pay

- Retirement Income

While those are some of the more common effective incomes, other types of military income, such as subsistence and clothing allowances, hazard pay, overseas pay, imminent danger pay and more may also be counted.

Questions on if you qualify? Speak with a home loan specialist and start your VA loan.

11. Variety of VA Loan Types

Many Veterans are surprised to hear how many financing options the VA loan benefit has. Not only can Veterans purchase a home with their VA loan benefit, but they can also make energy-efficient upgrades, take equity out of their home and refinance into lower interest rates.

| Loan Type | Description |

|---|---|

| VA Purchase Loans | One of the most commonly used financing options by Veterans. Veterans use this type of loan to purchase a primary residence. |

| VA Energy Efficient Mortgage (EEM) | VA EEMs allow Veteran homebuyers to invest in qualified energy efficient upgrades when purchasing or refinancing a home. These improvements can help reduce utility costs over time. Homeowners may be able to finance qualified upgrades directly into their loan. |

| VA Renovation Loan | A VA renovation loan, or VA rehab loan, allows Veterans to purchase or refinance a home while financing approved repairs or updates. You can combine the costs of purchasing or refinancing a home and completing renovations into a single VA loan. |

| VA Interest Rate Reduction Refinance Loan (IRRRL) | Also referred to as a VA Streamline refinance, IRRRLs are an excellent option for Veterans who want to lock into a lower interest rate or refinance out of an adjustable-rate VA loan. This option is only for Veterans with active liens. |

| VA Cash-Out Refinance | A VA Cash-Out refinance allows Veterans to access their home equity in exchange for cash. This option can help with paying off debts, funding home improvements or managing emergencies. It’s also available for refinancing non-VA mortgages. |

| Native American Direct Loan | A Native American Direct Loan helps Native American Veterans or non-Native American Veterans married to a Native American buy, build or improve a home on federal trust land. |

12. No Loan Limits

While VA loan limits used to be enforced for all Veteran homebuyers, that is no longer the case. Now, Veterans with their full VA loan entitlement can borrow as much as they can afford without the need for a down payment.

Previously, these county-level limits helped determine how much Veterans could buy before this zero-down loan program required a down payment. However, the VA loan limits still come into play for Veterans with diminished entitlement. In these cases, Veterans who want to purchase above where their entitlement caps out must put down a quarter of the difference between that figure and the home’s purchase price.

13. Funding Fee Exemptions

The VA Funding Fee is a required governmental fee applied to every VA loan. The money goes directly to the VA to help cover any losses and keep the VA loan guaranty running. While most borrowers pay between 2.15% and 3.3%, some Veterans are exempt altogether.

Veterans exempt from paying the funding fee include:

- Veterans who receive compensation for a service-connected disability

- Veterans who would receive disability compensation if they didn't receive retirement pay

- Veterans rated as eligible to receive compensation based on a pre-discharge exam or review

- Veterans who can but are not receiving compensation because they're on active duty

- Active duty Purple Heart recipients

- Surviving spouses who are eligible for a VA loan

14. Assumability

Assumability is an under-the-radar benefit of VA loans that can give Veteran home sellers a huge advantage during a time of higher mortgage rates.

With a VA loan assumption, a buyer essentially takes over the Veteran’s existing mortgage, including their interest rate. VA homeowners can offer prospective buyers the chance to lock in ultra-low rates that aren’t available anywhere else.

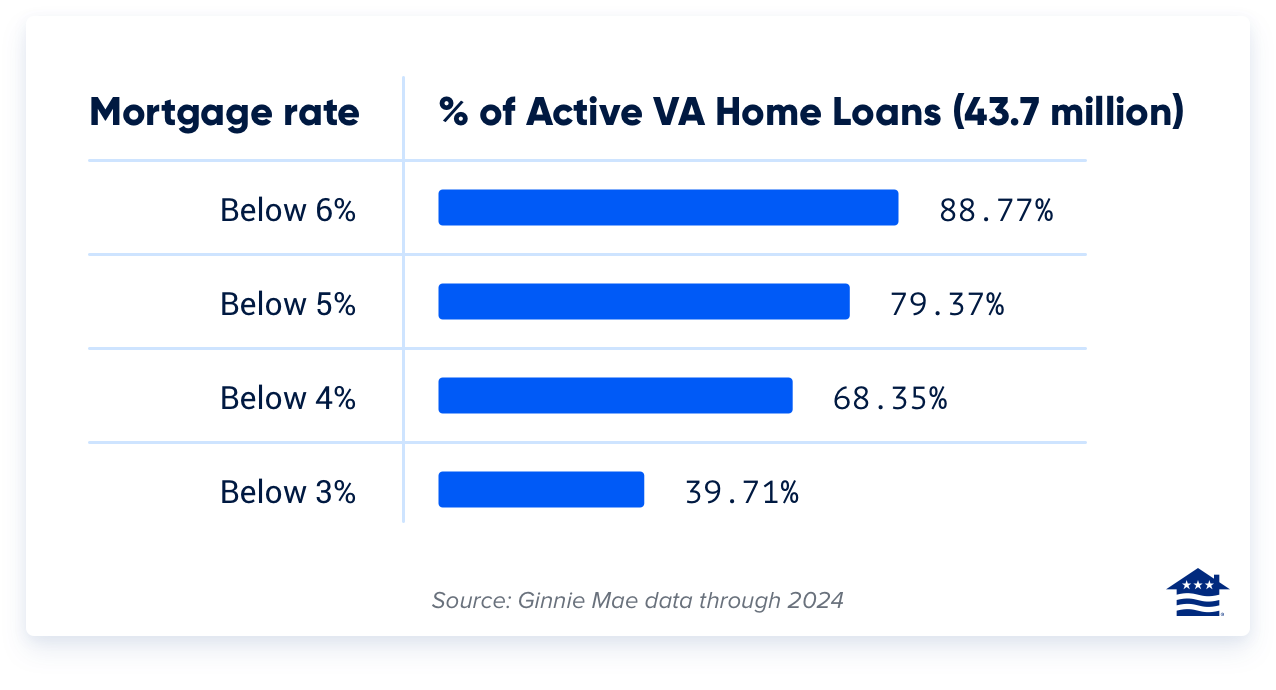

Nearly 8 in 10 active VA loans have a mortgage rate below 5%, according to an analysis of Ginnie Mae data through 2024:

Along with low rates, loan assumptions have few closing costs, because you’re not getting a new mortgage. Veterans and non-Veterans can assume a VA loan, provided they meet servicer and VA guidelines.

Veterans should understand that their VA loan entitlement remains tied up in the home unless the person assuming their mortgage is another Veteran who’s substituting their entitlement for the homeowner’s. Otherwise, Veterans would have more limited ability to reuse their VA loan benefit – and possibly be unable to access it at all.

Common Questions on VA Loan Benefits

What is the Best VA Loan Benefit?

Every financial situation is unique; however, many VA borrowers cite no down payment as the top VA loan benefit.

Are VA Loans Better Than Conventional?

It depends on the individual homebuyer, but VA loans typically have lower interest rates than conventional loans and require no down payment. VA loans also come without mortgage insurance costs, which can limit your buying power.

Are There Any Benefits to Sellers?

The main benefit to sellers is that VA buyers are about as safe a bet as you can find. Additionally, the VA doesn’t require sellers to pay for anything on behalf of a VA buyer. Closing costs are always a matter of negotiation between buyer and seller.

What Are Veterans United’s Benefits?

Veterans United has been the nation’s Top VA Purchase Lender for nine consecutive years. Mortgages backed by the U.S. Department of Veterans Affairs are among the most valuable benefits provided to active duty service members, Veterans and their families.

Check out our 2,002 unfiltered reviews to see for yourself.

1 Our military advisors are paid employees of Veterans United Home Loans.